Table of Contents

Our Proposal

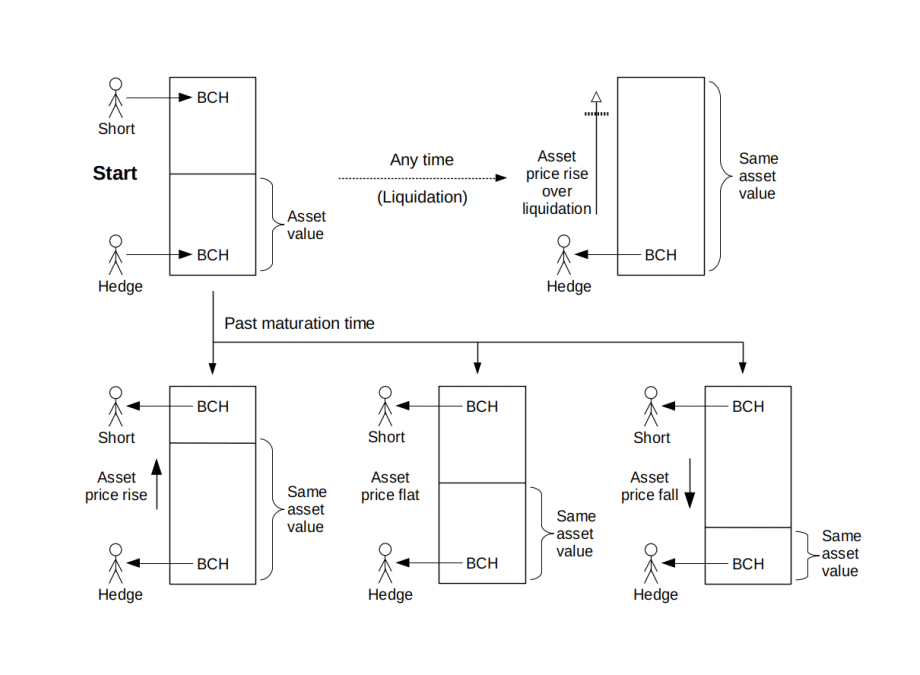

Observing the shortcomings of each approach above, we propose AnyHedge, a novel, transactional, collateral-based solution that has no systemic dependencies or single points of failure.

An AnyHedge contract involves at the minimum three parties: Hedge, Short, and Oracle. Only Hedge and Short have coins involved while Oracle does not need to be aware of the contract at all. It operates much like a subset of traditional futures and forward contracts.

- Hedge is an entity who seeks to secure future value against an external asset such as the US Dollar, using coins of a native cryptocurrency such as Bitcoin Cash.

- Short is a counterparty who seeks to take volatility risk of an external asset, betting that the external asset will fall in value against the coins they provide for collateral. In 5. Regarding price orientation we describe the orientation of prices, Bitcoin Cash per external asset, that make this counterparty short on the external asset as opposed to long on Bitcoin Cash.

- Oracle is an entity who provides cryptographically signed price messages for the external asset.

Hedge and Short agree on a few simple parameters that define the main behavior of the contract.

- Maturity is the time after which the contract can be redeemed under normal conditions.

- Fixed Value is the amount of external asset that Hedge would like to protect against volatility.

- Volatility Pool is the collateral provided by Short to protect Hedge’s Fixed Value.

The contract uses signed messages from Oracle to determine the price of the external asset.

Hedge enters the contract with an amount of coins equal to Fixed Value, and exits the contract at Maturity with coins equal to Fixed Value. Short enters the contract with coins for Volatility Pool. As the price of the external asset fluctuates, so does the size of Short’s Volatility Pool in order to maintain Hedge’s exit at Fixed Value. If the price of the external asset falls relative to the cryptocurrency, Short’s Volatility Pool grows due to the contract requiring less coins to cover Hedge’s exit at Fixed Value. If the price of the external asset rises, Short’s Volatility Pool shrinks. In essence, Hedge gains a peg on the external asset for their coins, while Short amplifies the risk and reward for theirs. Before Maturity, if the price of the external asset rises to a threshold where all of Short’s Volatility Pool is required to cover Hedge’s exit at Fixed Value, the contract enters liquidation. In liquidation, Hedge immediately receives coins worth Fixed Value. Given enough liquidity, Hedge can immediately enter a new contract to minimize or eliminate slippage.

AnyHedge contracts have the following properties:

- Each transaction is self-contained. Parameters and circumstances within a contract do not affect any other contracts.

- Oracle does not need to be aware of any transactions, its sole task is to provide accurate price information.

- Given access to an Oracle, Hedge and Short can permissionlessly enter a contract independent of any other coordination mechanism or parties.

- Exact parameters of the contract, including incentives and even pegged asset type, remain private until redemption.

- At no point do claims to funds leave Hedge and Short. No custodian is involved.

The contracts can be constructed with a wide variety of configurations. Amount of Fixed Value, size of Volatility Pool which determines liquidation risk, Maturity, premiums paid from Hedge to Short or vice versa, and fixed fees to arbitrary parties are all configurable.